Binance Coin (BNB) just hit a new all-time high, surging to $804 a few hours ago as momentum in select altcoins continues despite broader market consolidation. While Bitcoin and Ethereum enter a period of sideways movement, BNB is breaking out with renewed strength. This bullish move comes amid strong fundamentals tied to Binance’s growing profitability and market dominance.

According to fresh data from CryptoQuant, Binance’s unrealized profit on its BTC reserves has climbed to a record 60,000 BTC, marking a new all-time high. This surge in unrealized gains is particularly notable given that Binance’s BTC reserves have actually been declining steadily since September 2024.

As institutional demand grows and altcoins attract renewed interest, BNB’s performance may be a leading signal of what’s to come for the broader market. With Bitcoin and Ethereum stabilizing above key zones, Binance Coin stands out as a top performer, underpinned by rising exchange profitability and investor confidence. The coming days could be pivotal in confirming whether this move has room to run.

Strategic Reserves: What Binance’s BTC Holdings Reveal

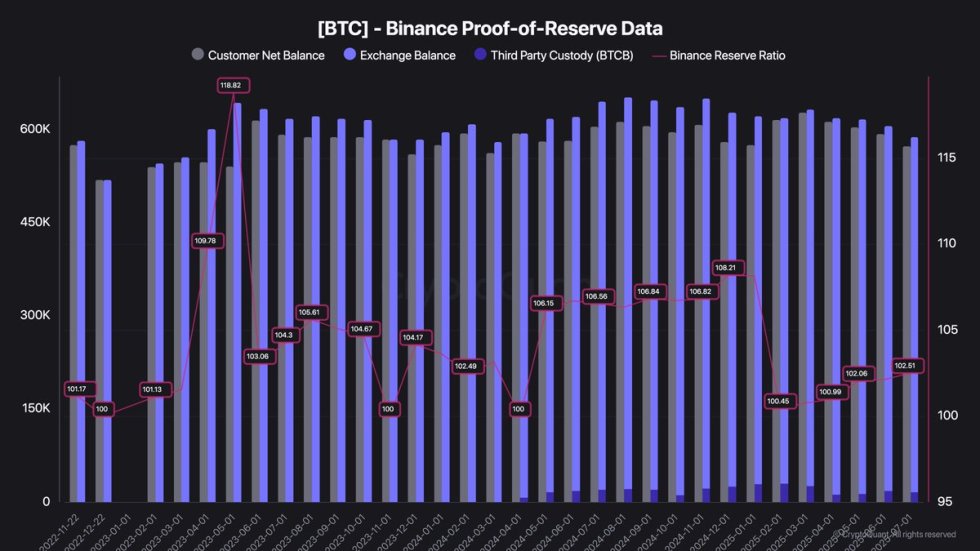

Top analyst Darkfost has shared critical insights into Binance’s Bitcoin reserves, shedding light on the strategic decisions underpinning the platform’s operations. According to Darkfost, Binance’s core BTC reserve—primarily used to support exchange activity and the BNB Chain ecosystem—has declined from approximately 631,000 BTC in September 2024 to 574,000 BTC today. This trend underscores a calculated shift in reserve strategy rather than weakness, aligning with broader market changes and demand dynamics.

In addition to this strategic reserve, Binance holds roughly 16,000 BTC in custodial wallets. These funds serve a specific purpose: backing the BTCB token and fulfilling user demand for tokenized Bitcoin within the BNB Chain environment. This structure allows Binance to maintain flexibility while ensuring liquidity and transparency across its ecosystem.

Tracking these reserves offers a unique window into macro sentiment. Declining exchange reserves often point to increasing confidence among long-term holders, as more Bitcoin is withdrawn for cold storage or long-term holding. This behavior signals growing conviction that prices will continue rising.

Notably, despite the reduction in total BTC holdings, the value of Binance’s remaining reserves has soared. The continued rally in Bitcoin’s price has pushed Binance’s unrealized profit to a record 60,000 BTC. This divergence, falling reserves yet rising profits, highlights the strength of this market phase and Binance’s ability to navigate it profitably. As the market matures, Binance’s reserve data will remain a valuable barometer of institutional and investor behavior.

Price Analysis: Breakout Pushes BNB Into Price Discovery

Binance Coin (BNB) has officially broken into uncharted territory, reaching a new all-time high of $804. The chart shows a sustained and aggressive uptrend, with BNB surging from the $670 zone in early July to nearly $800 in just weeks. This move confirms bullish momentum and strong market confidence.

All key moving averages—50-day ($671), 100-day ($652), and 200-day ($642)—are trending upward, and price is well above all of them. This alignment confirms a robust bullish structure. The recent price surge has also been supported by a noticeable rise in trading volume, further validating the breakout.

BNB has cleared all major resistance levels and is now in price discovery, meaning it’s exploring new highs with little technical resistance overhead. The clean break above the $720–740 zone was a key trigger for acceleration.

Traders should now watch the $780–790 area as short-term support. As long as BNB holds this range, the bullish trend remains intact. With no historical resistance ahead, momentum could push toward $850 or higher—especially if market sentiment stays strong and BTC/ETH remain in consolidation.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.